IFC Markets Broker Review

We review IFC Markets broker; IFC Markets broker is a powerful broker in terms of security, which allows Iranians to use its services. The number of Iranian ifc broker clients is not tiny at all, and this broker has been able to attract a lot of attention from all over the world.

| Broker name | IFCmarkets |

| Established year | 2006 |

| Spread rate | Down |

| Central office | United Kingdom |

| Regulation | IFC |

| Minimum deposit | $ 10 |

| The easiest way to deposit and withdraw | Perfect Money, Web Money, Ethereum , Tether, Bitcoin |

- Summary Of Broker IFC Markets

Cent Account

Copy Trading

Spread Reduction Trick

Islamic Account

Permission To Trade Scalping

What you will read on the IFCMarkets broker page:

- IFC Markets Broker Review Video

- IFC Markets Broker Credit

- Where is IFC Markets Brokerage Headquarters?

- IFC Markets Broker History

- Table of introduction and comparison of types of accounts in IFC Markets broker

- The spread rate in IFC Markets broker

- Islamic account in IFC Markets broker

- Deposit and withdrawal at IFC Markets brokerage

- IFC Markets Broker Bonuses

- Necessary documents for identification

- IFC Markets Broker Trading Platforms

- Is IFC Markets Broker a scammer?

- Advantages and disadvantages of IFC Markets broker

- IFC Markets Broker Registration Tutorial with Image

IFCMarkets broker registration training

IFC broker registration training is fully available on the eight hundred sites, and you can download the file related to IFC registration training by clicking on the pdf logo.

IFC Markets Broker Registration Training

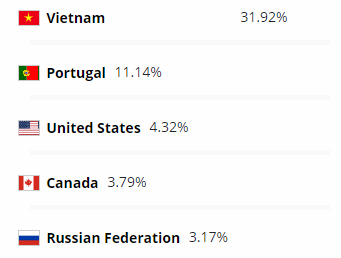

Which countries have the most IFC broker clients?

IFC Markets Broker Credit

Due to the long history of IFC brokers and robust regulation, IFC Markets broker can be considered a very reliable and high-security broker, so traders can invest and open an account in this broker with ease…

Is there an IFC broker regulated?

The IFC Markets broker is regulated by the Labuan Financial Services Authority (LFSA) and the British Virgin Islands Financial Services Commission (FSC). However, this broker already has the expired Cyprus Securities and Exchange Commission (CYSEC). If this broker renews the validity date of the regulation (CYSEC), we will inform on site Dartina .

CYSEC Regulations

FSC Regulations

IFSA Regulations

Where is IFC Markets Broker Headquarters?

IFC Broker is headquartered in the United Kingdom.

What is the history of IFC Broker?

IFC Broker was established in 2006 and has more than fifteen years of experience providing customer service.

Table of introduction and comparison of types of accounts in IFC broker

| Profile / account name | Standard mt4 account | Micro mt4 account | Mt5 standard account | Micro mt5 account |

|---|---|---|---|---|

| Minimum deposit for opening | $ 1000 | $ 10 | $ 1000 | $ 10 |

| Maximum leverage | 1: 200 | 1: 400 | 1: 200 | 1: 400 |

| Spreads | Fixed 1.8 pips | Fixed 1.8 pips | Spread of 0.4 pips | Spread of 0.4 pips |

| Ability to trade currency pairs | Yes | Yes | Yes | Yes |

| Ability to trade stocks and indices | Yes | Yes | No | Yes (at least 1 lot) |

| Possibility of digital currency trading | Yes | Yes | Yes | Yes |

| Commission | 0 | 0 | 0 | 0 |

| Allow scalping | Yes | Yes | Yes | Yes |

| Permission to use Expert | Yes | Yes | Yes | Yes |

As you can see in the table above, IFC Markets broker offers two different types of accounts to traders that have almost the same features. In the following, we will examine the details of these accounts.

Open a standard account at IFC Broker.

The minimum deposit to open a standard account at IFC Markets Broker is one thousand dollars, and traders have no limit on the deposit ceiling in this account.

This account has no commission, and only commissions are received from traders in stock trading.

The spread of this account is different in different trading software. MetaTrader has four fixed spreads and 1.8 pips, and in MetaTrader, it has five spreads starting from the 14th pip. Are you a fixed spread of 1.8, or do you want to open an account with a variable spread that begins at four-tenths of a pip?

The maximum leverage used in this account is one to two hundred.

Open a micro account at IFC Broker.

You can open a micro account in IFC Markets broker with only a deposit of ten dollars; the deposit limit in this account is $ 5000.

The maximum leverage that traders can use in this account is one to four hundred.

The IFC broker only receives commissions from traders for stock trading, and trading with other symbols has no commission.

The number of spread brokers receives from traders varies according to their trading software; for example, in MetaTrader software, five broker spreads are variable and start from the fourteenth pip. In MetaTrader trading software, four spread spreads are fixed and 1.8 pips. Also, in the Net Tridix trading platform, you can choose a fixed spread account, i.e., 1.8 pips, or a variable spread account starting from the fourteenth pip, according to your taste.

IFC Markets broker spread rate

IFC broker spread rate varies according to the trading software that traders choose. Traders in this broker can determine whether their account spread rate is fixed or variable; IFC broker in MetaTrader software has four fixed spreads of 1.8 pips Offers and in MetaTrader trading software offers five variable spreads starting from the fourteenth pip also, in Net Tridix traders can choose fixed or variable spreads according to their strategy, of course, in general, the amount The spread of this broker can be considered as a moderate amount compared to other brokers.

Islamic Account of AFC Markets Broker

Having an Islamic account without swaps is a good feature of an IFCmarkets broker. The difference between Islamic accounts and other accounts is that traders can trade without paying exchanges or overnight interest in Islamic accounts.

How much capital can be used to open a natural or real account in IFC Market brokerage?

The minimum amount required to invest and open an account with an IFC broker is ten dollars.

Deposit and withdrawal in IFC Markets broker

Deposit and withdrawal methods in IFC Markets broker are very diverse. They include different deposit and withdrawal methods such as deposit and withdrawal, Perfect Money, Web Money, Ethereum , Tether, Bitcoin, and …

Bonus Broker IFC markets

One of the exciting features of brokers is offering various attractive bonuses that encourage individuals and traders to invest in the relevant broker.

IFC markets broker also offers several bonuses to traders that you can use these bonuses by opening an account in this broker; you can get more information about IFC broker bonuses to the main website of this broker Visit or subscribe to the Telegram channel of Dartina site to be informed about the rewards of this broker and other brokers.

What documents are required to authenticate and open an account at IFC Broker?

Registration and authentication in IFC Markets broker are straightforward, you only need to enter information such as email address and mobile number in the registration section of the IFC site, and then after confirmation of the initial steps, you must color scan and Submit your ID and proof of residence to IFC Broker Support.

Trading and trading assets in IFC Broker

The IFC Broker offers many symbols for traders to trade, including digital currencies, Forex cryptocurrency, precious metals, and…

IFC Broker Trading Platforms

IFC Markets broker supports three trading platforms for its services, including MetaTrader 4 and 5 and NetTradex.

You can click on the links below to download and download this software.

MetaTrader 5

MetaTrader 4

Is IFC Markets Broker a scammer?

IFC Markets Broker has a history of more than fifteen years, and during these years, there have been no specific cases of fraud or security problems, but if we receive a report about such issues, be sure to do so. We will provide information on the site Dartina.

Benefits of IFC Markets Broker

- High reputation

- Low spreads

Disadvantages of IFC Markets Broker

- Lack of trading copy system

Register in a IFC broker

First, enter the IFC market broker site through the following link.